irb malaysia e filing

If the company is starting up for the first time the assessment must be filed with the IRB within 3 months from the starting date of their operations but not 30 days before the start of the base period. Bagi meningkatkan ketelusan dan penglibatan awam dalam pentadbiran cukai langsung Lembaga Hasil Dalam Negeri Malaysia HASiL mengalu-alukan orang ramai untuk menyertai Konsultasi Awam.

Irb Media Release 160812 Temporary Closure Of E Lejar System

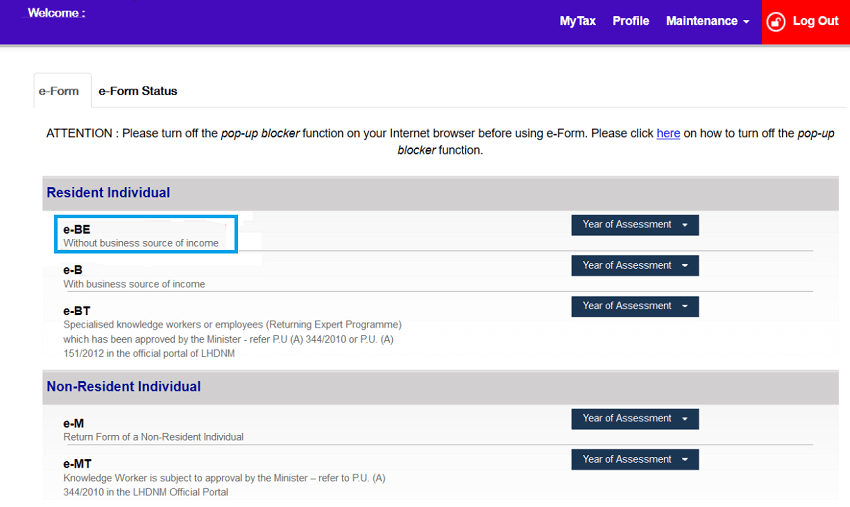

Click on e-Form link under e-Filing menu.

. Damansara Holdings Bhds DBhd wholly-owned subsidiary Damansara Realty Johor Sdn Bhd DRJ has been slapped with an additional income tax bill with penalty of RM2906 million from the Inland Revenue Board IRB. Settlor transfers ownership to a persons ie. KUALA LUMPUR Sept 6.

6 to 30 characters long. The individual must first report it to the LHDN. Filing a tax assessment in Malaysia is compulsory under section 107C of the Malaysian Income Tax Act 1967.

IHH Healthcare Bhds share price slipped below RM6 for the first time in more than a year on Thursday Sept 22 amid broader market weakness and after Indias Supreme Court refused to lift the stay on IHHs open offer for Fortis Healthcare Ltd sharesIHH fell as much as 15 sen or 246 to RM595 before closing the day at RM6 on a. A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. ORANG RAMAI DIALU-ALUKAN UNTUK MENYERTAI KONSULTASI AWAM DENGAN HASiL.

All cities other than Kuala Lumpur. Income Tax Transfer Pricing Rules 2012 TP Rules. After these taxes are reduced by any credits claimed under section 3111e and f of the Code 3 sections 7001 and 7003 of the Families First Coronavirus Response Act.

Allow multiple user to access and update a clients file concurrently. Inclusive of Personal e-Filing. KUALA LUMPUR Sept 22.

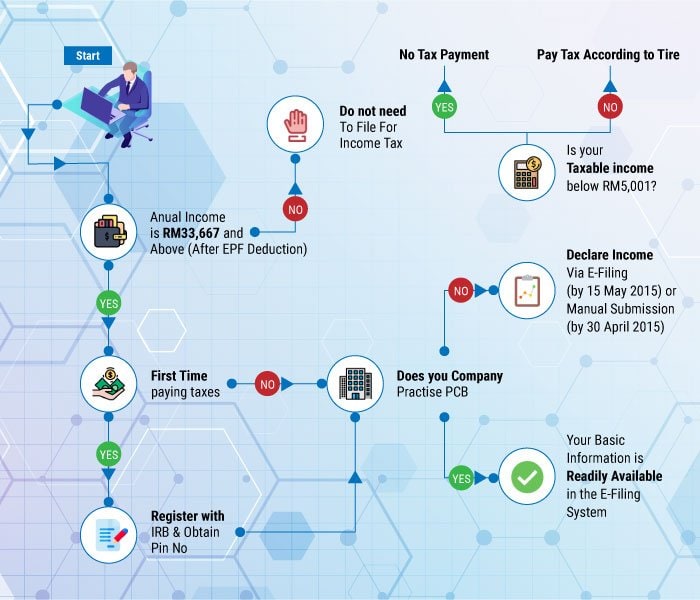

The following rules and guidelines have been issued by the IRB. However it does not need to be submitted with the tax return. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

EzHASiL System will display screen as below. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. In 2015 as a result of police officers being accused of crimes such as rape torture and murder the cost of civil liabilities.

Support PC running Windows 7 8 81 10 11 3264 bit Able to calculate Carry-back losses YA 2009 Calculate Section 60F deduction. KUALA LUMPUR Sept 15. Tuan Zulkifli said that according to Section 4 of the Income Tax Act 1967 and the rules any income or profit received from other than employment must be reported to the IRB.

In terms of assessment if the donation is received by an individual it should be reported to the LHDN regardless of its purpose. Destini Bhds indirect subsidiary Destini Shipbuilding and Engineering Sdn Bhd DSBE has been served with a winding-up petition from the government after it failed to pay RM624 million of a settlement payment proposal to the Inland Revenue Board IRBDSBE had been embroiled in a legal dispute with the IRB in relation to RM658 million it. The Guardian reports that incidents of police brutality skyrocketed by 312 from 2011 to 2012 compared to 2001 to 2002 with only 1 in 100 cases leading to a conviction.

ASCII characters only characters found on a standard US keyboard. Tuan Zulkifli said that according to Section 4 of the Income Tax Act 1967 and the rules any income or profit received from other than employment must be reported to the IRB. The 21st prosecution witness also confirmed that Shahrir had used his username and password to declare his income for those years via e-Filing on the IRB website.

The process of registering is as follows. The 21st prosecution witness also confirmed that Shahrir had used his username and password to declare his income for those years via e-Filing on the IRB website. Select applicable form type and Year of Assessment.

Must contain at least 4 different symbols. There were also 720 deaths in police custody due to police action from 2011 to 2012. Apply for PIN Number Login for First Time.

MMAG Holdings Bhds trading volume spiked past 909 million securities to its highest on record on Wednesday Oct 5 from just 716400 units on Tuesday. Mobile TaxComp - Allow users to compute TaxCompe-filing at anytime and anywhere. The High Court was told today that former Felda chairman Tan Sri Shahrir Ab Samad never declared an income exceeding RM1 million for the assessment years 2013 to 2018 to the Inland.

Documentation should be in place by the time of filing of the tax return seven months after the FY end. OM Holdings Ltd OMH via its subsidiary OM Materials S Pte Ltd OMS has fulfilled conditions to acquire the remaining 25 interest in key Malaysian operating subsidiaries OM Materials Sarawak Sdn Bhd and OM Materials Samalaju Sdn Bhd from Cahya Mata Sarawak Bhd CMS for a total cash consideration of. User Manual e-Form ezHASiL version 33 User Manual e-Form ezHASiL version 33 8 14 e-Form Services screen will be displayed when users successfully login ezHASiL as below.

And the reconciliation of the advance payment at the time of filing the employment. Legal title to the trust property is vested in the. Before you can complete your Income Tax Returm Form ITRF via ezHASiL e-Filing the first step you have to take is to Register at ezHASiL e-Filing website.

It sets out the interpretation of the Director General of Inland Revenue in. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. You may also update below details by using our.

Trustee who is to hold and control the property according to the owners instructions for the benefit of a designated person or persons ie. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. With effect from 1 st July 2022 change of address can only be made through Notification of Change in Address Form CP600B Pin 12022 and accepted either submitted by hand or by post or update online via e-Kemaskini only.

KUALA LUMPUR Sept 26. The first RM100000. Malaysia follows a progressive tax rate from 0 to 28.

Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing. KUALA LUMPUR Oct 5. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality.

This is for years of assessment 2016 to 2019In a filing with Bursa Malaysia on Monday Sept 26 DBhd said the. Please bear in mind that you must be registered as Taxpayer prior to registering for ezHASiL e-Filing. TRUST -- A trust is a legal arrangement whereby the owner of property ie.

Submission via Customer Feedback Form or email is NOT ALLOWED and will not be processed. Its share price after doubling to seven sen in intraday trade from 35 sen a day earlier ended at an all-time low of 25 sen on profit-takingAt 5pm the counters trading volume stood.

Submit Tax Returns Via E Filing By May 15 Irb 马中透视 Mci

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

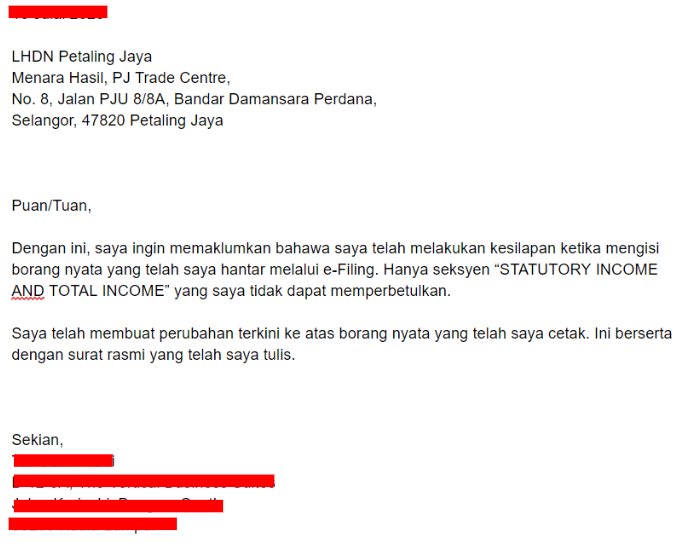

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Simple Faq E Filing Lhdnm For Malaysian Working In Singapore Miniliew

E Filing For 2021 Income Tax Begins March 1

Guide To Using Lhdn E Filing To File Your Income Tax

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Guide To Using Lhdn E Filing To File Your Income Tax

How To Prepare File And Submit Lhdn E Filing 2021 Conveniently

Income Tax Filing Malaysia E Filing And Corporate Tax Return

Ctos Lhdn E Filing Guide For Clueless Employees

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Pdf E Filing System Practiced By Inland Revenue Board Irb Perception Towards Malaysian Taxpayers

Comments

Post a Comment